2028年OLED発光材料市場、年平均5.8%の成長率で24.3億ドルと展望する

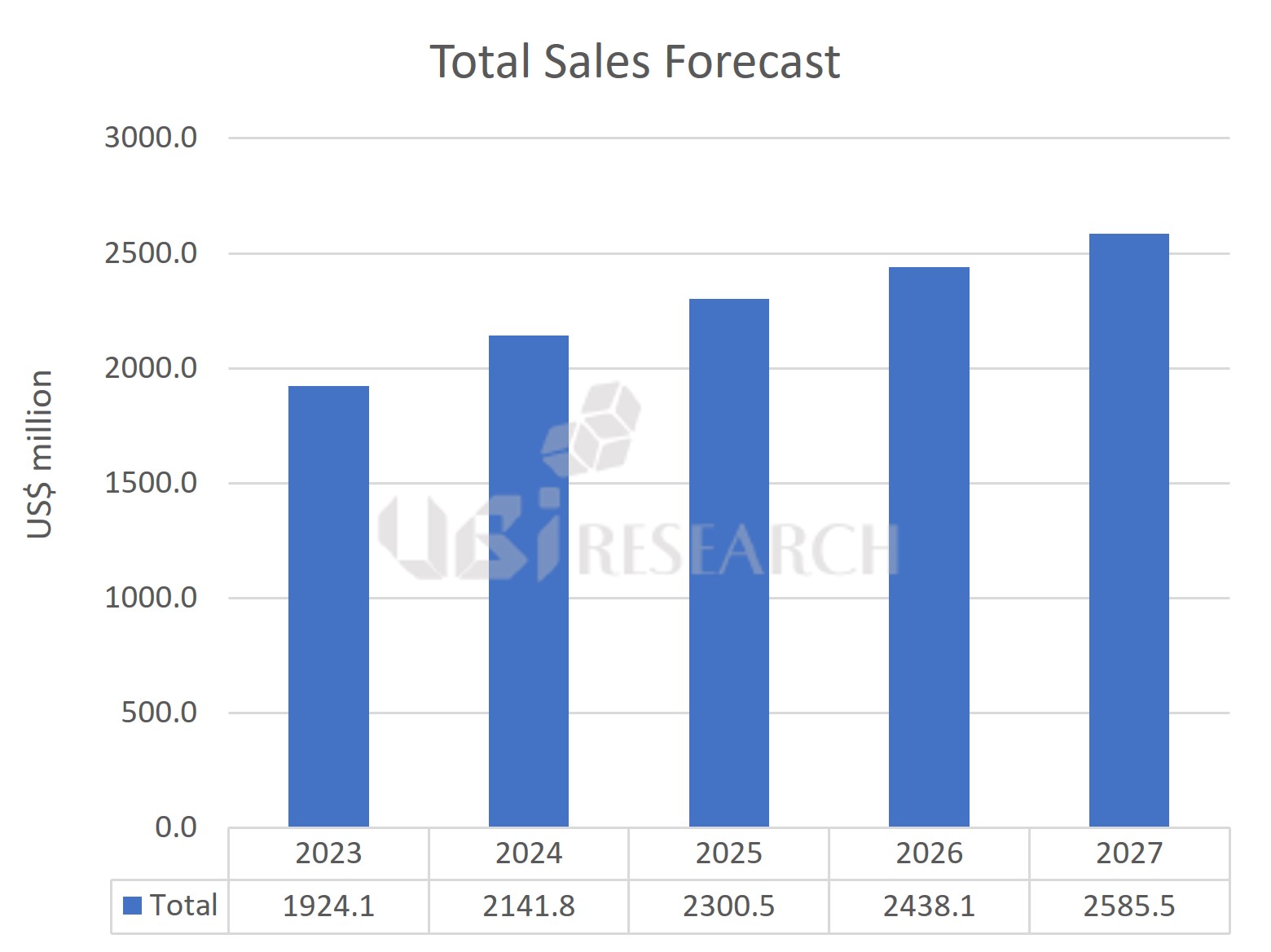

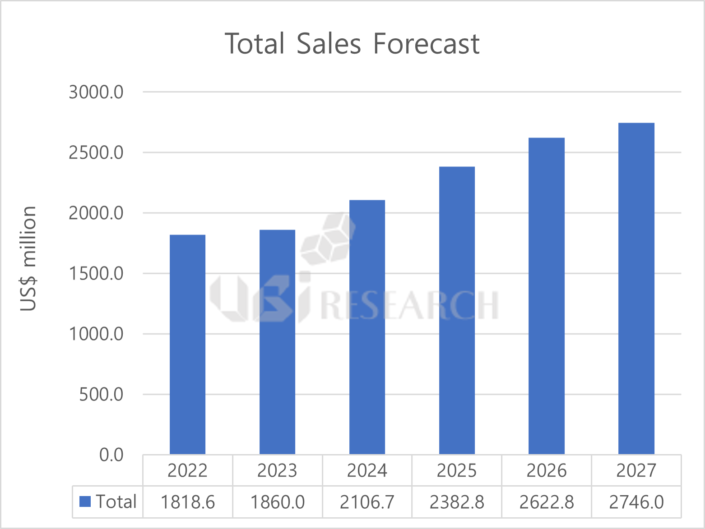

UBIリサーチより最新発刊された「4Q23_Quarterly OLED Emitting Material Market Tracker」によると、OLED発光材料市場は2023年の18.4億ドルから年平均5.8%の成長率で2028年には24.3億ドルに達するとの見通しだ。

国別では、韓国のパネルメーカーの材料購買額は2023年11.1億ドルから年平均4.2%の成長率で2028年には13.6億ドル、中国の材料購買額は2023年7.3億ドルから2028年10.7億ドルになると予想した。

想定内の結果となった場合、2028年の国別材料購入比率は韓国が56%、中国が44%となるるが、中国のパネルメーカーは中国内需向けとwhite box向けにパネルを主に量産しているため、今後パネル出荷量が増加したとしても低価格材料が使用されると予想され、中国の発光材料市場の成長率は現在の予測より更に縮小する可能性もある。

また、UBIリサーチは2028年、サムスンディスプレイの発光材料購買額を8.1億ドル、LGディスプレイは5.5億ドル、BOEは4.4億ドルに達すると予測した。

4Q23 OLED Emitting Material Market Track

4Q23 OLED Emitting Material Market Track