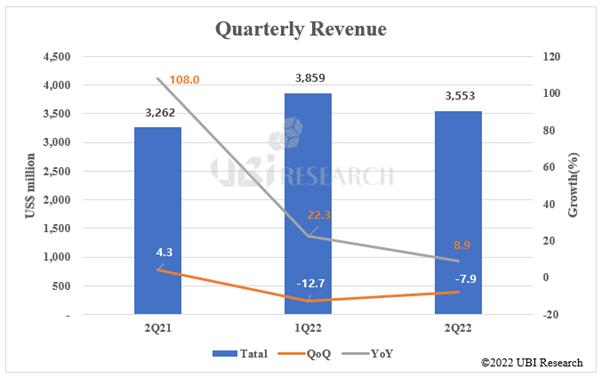

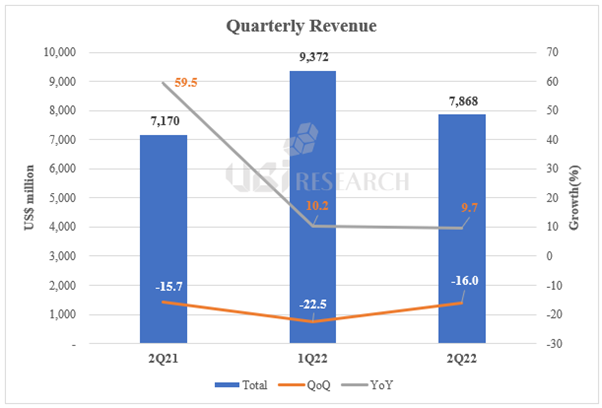

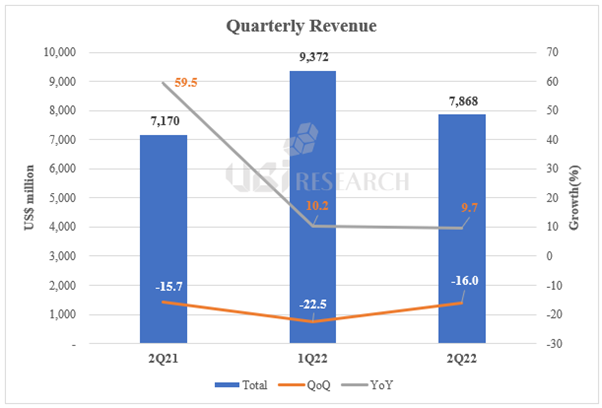

UBIリサーチが四半期別発刊する「3Q22 Small OLED Display Market Track」によると、2022年第2四半期の小型OLEDディスプレイ市場は78.7億ドルと集計された。

2022年第2四半期の小型OLEDディスプレイ市場は前期比16%減少し、前年同期比9.7%上昇した。世界最大市場である中国市場は、新型コロナウイルス感染症の余波で上海と一部地域が封鎖され、スマートフォンなどモバイル機器が萎縮した。

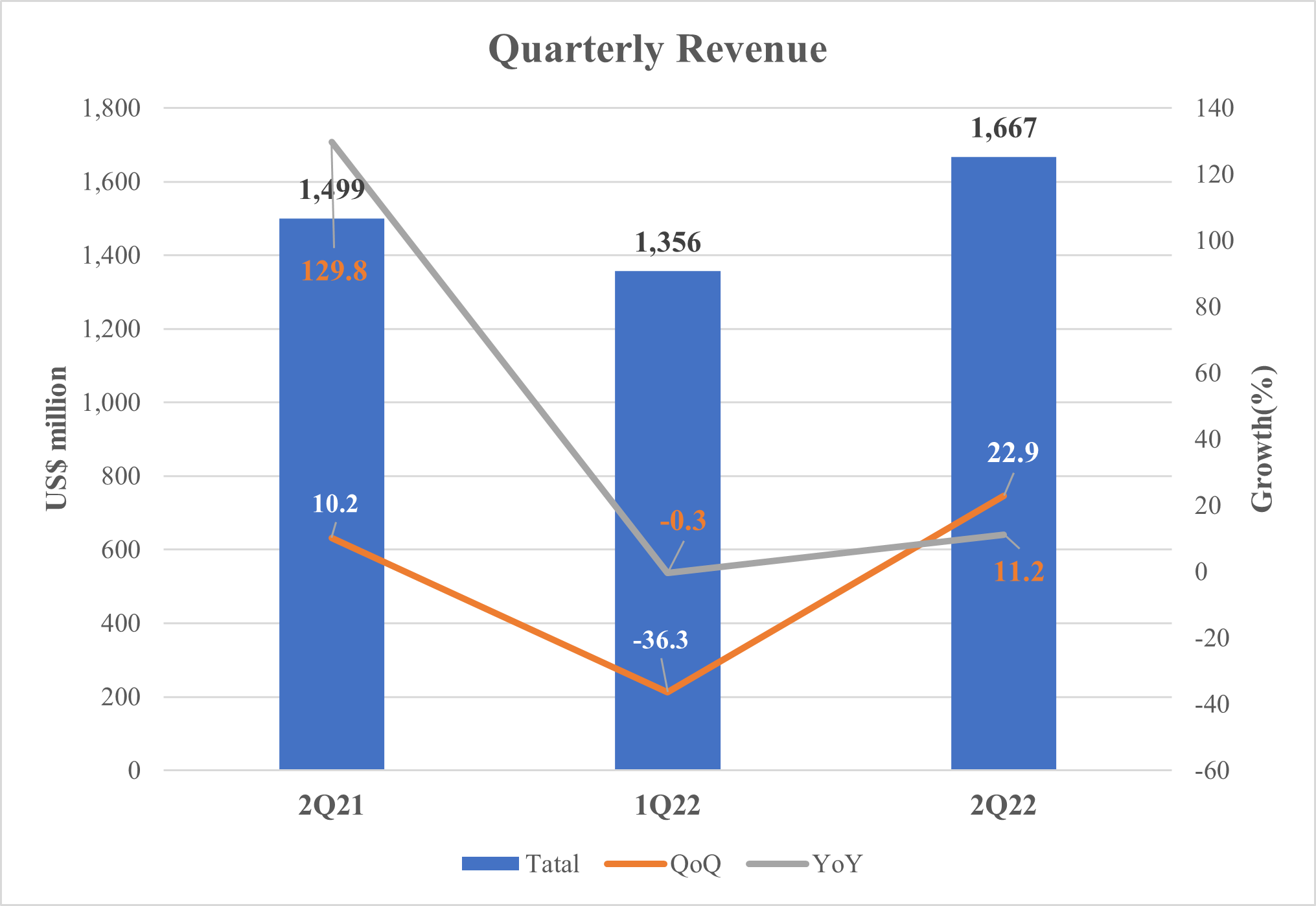

これに伴い、小型OLEDパネル出荷量は第1四半期1億5000万台から第2四半期では2000万台減った1億3000万台と集計された。 第2四半期のフォルダブルOLEDパネル出荷量は312万台で、第1四半期より12万台増えたが、市場規模は期待に及ばなかった。

2022年第2四半期小型OLED市場

最近、中国の一部パネル業者がスマートフォン用OLEDパネル価格を30ドル以下に出しており、リジッドOLED市場が急激に萎縮する見通しだ。

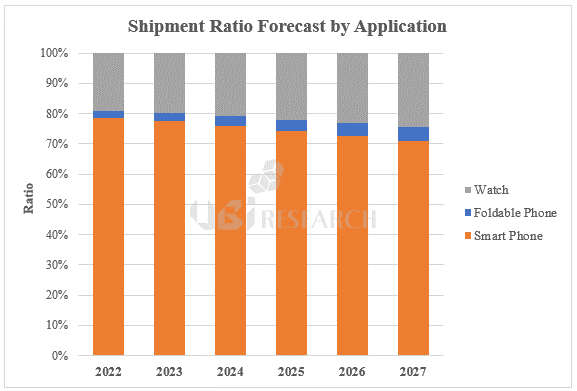

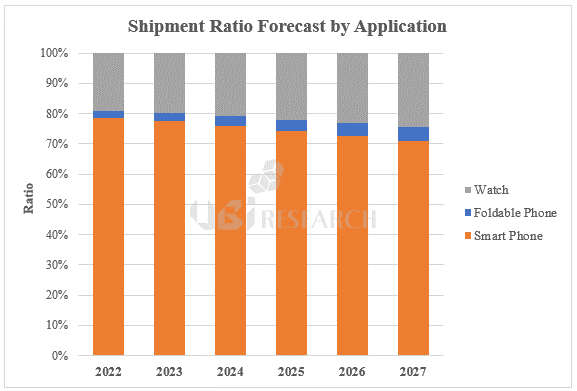

今年のFoldable OLEDの予想出荷量は1640万台で、昨年1,030万台から610万台に増える見通しだ。フォルダブルフォンはサムスン電子のギャラクシーノートに代わるものと予想されるが、追加需要は発生していない。 また、中国パネル企業のFoldable OLED用UTG購買困難は、中国スマートフォン企業のフォルダブルフォン生産に影響を及ぼしており、フォルダブルOLED市場の成長速度が速くないものとみられる。2027年、フォルダブルフォンOLED出荷量は4200万台に大きく修正された。

小型OLEDディスプレイを応用製品別(Watch, Smart phone, Foldable phone)に分け、2027年までの予想出荷量を100%ベースの累積グラフで示した。

2022年第2四半期の小型OLED出荷量および展望

2022年小型OLEDディスプレイパネルの総出荷量は7億2480万台と予想され、5年後の2027年には9億3780万台を記録するものと推測される。2022年応用製品別フォルダブルフォンが占める割合は2.3%であり、2027年には4.5%まで増加するものと展望される。

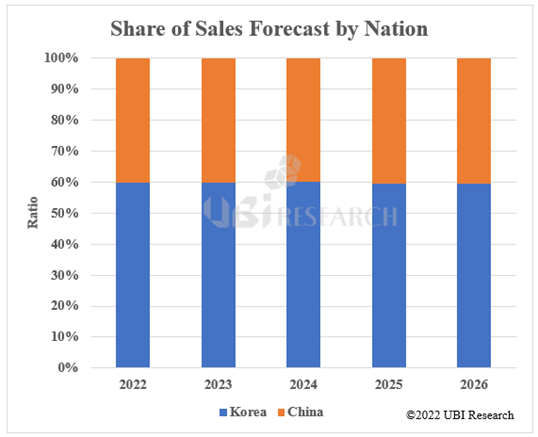

「3Q22 Small OLED Display Market Track」は10インチ以下の小型OLED Displayに対するOLED生産キャパ現況を分析し、主要パネル業者別、国別、世代別、基板別、TFT技術別、応用製品別(Watch、Smartphone、Foldablephone)など主要製品群に対する細部的な四半期別売上高と出荷量を調査した。アプリケーション別ASPとOLED需要/供給を分析し、今後5年以降2027年までに小型OLED Displayの市場展望分析資料を提供する。

関連レポート:OLED マーケットトラック